Stuck on a Medicare Advantage plan and unhappy?

Don’t worry, we can help with options!

Although options are many, there are two main open period events where Medicare Products which hold annual ‘open enrollments’ each year which allows plan changes.

Fall Medicare Open Enrollment. Oct 15th- Dec 7th: Encompasses Medicare Advantage, Medicare Part D Rx

Medicare Advantage Open Enrollment. Jan 1st to March: Encompasses Medicare Advantage only

Other open enrollment qualifying events also exist for existing Medicare Advantage enrolless & SEP or loss of coverage events on a smaller scale which we will discuss further as well.

Fall Medicare Open Enrollment

Each year in the fall Medicare holds an Open Enrollment from October 15th to December 7th. You can make several types of enrollments and changes at this time:

MEDICARE ADVANTAGE

Enroll in Original Medicare if you are currently enrolled in a Medicare Advantage plan

- Medicare Supplement plan can apply but not guaranteed issue

- Part D Prescription Drug application is allowed guaranteed issue

Newly enroll in Medicare Advantage if you are on Original Medicare A+ B

Switch Medicare Advantage plans if currently a Medicare Advantage member

Change Medicare Advantage plans to a plan with Part D RX plan bundled, or move to a Medicare Advantage plan without Part D RX bundled.

MEDICARE PART D RX

Medical issues come and go. Your health situation is always, changing. That is the constant! Doctors try different prescriptions and remedies so your prescription plan has to adapt.

We can try to help you fix this! You can shop Medcare Part D RX plans each year at this time at the AEP open enrollment searching out a plan and insurance carrier which may cover your new prescriptions (or alternatives).

If you are enrolled in Original Medicare A&B with Supplement you can enroll in a new Part D RX plan whether or not you are a late enrole or not.

You can also cancel your Medicare Part D RX coverage but buyer beware! There is a penalty on individuals who drop Part D RX coverage for greater than 63 days if you re-enroll at at later time with the coverage gap.

Here is more great information on the Part D RX penalty.

The penalty isn’t a huge percentage but unfortunately stays with you for life.

Plan changes and new enrollments processed during the Fall Medicare Open Enrollment (AEP) Oct 15th to Dec 7th period are effective January 1st.

It is important to note if you are happy with your Medicare health plan and your Part D RX plan there is no need to do ANYTHING. Your plans will automatically renew.

MEDICARE ADVANTAGE OPEN ENROLLMENT Jan 1st -March 31st

Are you enrolled on a Medicare Advantage plan and have missed the Fall Medicare Open Enrollment!! Fear Not.

From January 1st to March 31st each year there is a Medicare Advantage Open Enrollment period for exsiting Medicare Advantage enrollees. In this period you can disenroll from Medicare Advantage plan and switch to Original Medicare A+B with Supplement PPO, or simply switch your Medicare Advantage plan within your same insurance carrier or at another

During the Medicare Advantage Open Enrollment window Jan 1st – March 31st you can make one plan change (not 2), but you CAN switch you plan if you just recently made an open enrollment change in the Fall Medicare Open Enrollment Oct. 15th – Dec. 7th effective dates January 1st.

You can only take advantage of this second Medicare Advantage Open Enrollment if you are currently enrolled in a Medicare Advantage plan.

Also don’t forget, Medicare Supplements or Medi-Gap plans don’t have an annual ‘open enrollment’ window each year after the initial eligibility window or qualifying event so keep this in mind if switching from Medicare Advantage to Original Medicare. You may qualify for a new Medicare Supplement plan but it’s medically underwritten based on health status.

Contact us if you have any questions on this!

AUTO RENEWAL?

If you are happy with your Medicare Supplement plan and just want to keep your coverage, you can do so by just paying your bill and the plan will ‘auto-renew’.

This also works for a Medicare Advantage plan ONLY if your current plan is going to continue to stay on the market.

If you missed your original eligibility election window to elect Medicare Part A & B you can use the Medicare Open Enrollment period spanning Jan 1st to March 31st, with coverage effective July 1st each year.

There is a penalty for late enrollees of Original Medicare A & B. Typically Part A is not the issue, as you are generally automatically enrolled in Part A unless you had to ‘buy-in’ for Part A.

Penalty for late enrollment into Original Part B is 10% for each year you are late enrolling vs. your original eligibility date.

Effective date of the late enrollment for Original Medicare Part B is July 1st if the Jan 1st – March 31st Medicare Advantage open enrollment is utilized.

COMMON MISTAKES

What if you’re happy with your current plan, should you just ‘auto-renew?’

It’s a mistake to ignore the Medicare Open Enrollment and not review your options.

Even if you are happy with your health plan coverage and costs, each year it’s possible there are changes on plan co-pays, premiums, and covered medical expenses…particularly with Medicare Advantage.

CMS released the base beneficiary premium amount for Medicare Part D plans in 2020 is $32.74, down from $33.19 in 2019. This means there was a possible downward trend on some Medicare Part D prescription plans and possible deals could be found on Part D drug plans.

If you see a lower premium on a Medicare Advantage plan or Part D prescription plan our advice is to proceed with analysis and great caution.

The cost of the plan is not just the monthly premiums.

Total Cost Includes:

- -medical expenses out of pocket: co-pays or coinsurance cost sharing

- -the monthly premium of the Medicare Supplement, Medicare Advantage plan, or Part D premium

- -the cost of Medicare Part B premiums itself to the federal government.

Sometimes the Medicare Advantage plan is cheaper because the provider network has changed or reduced. You might be missing doctors or your primary care medical group utilized in the past year.

Another common issue under Medicare Advantage or Medicare Part D is changes to the drug formulary list. It’s possible your existing prescription drug drops from the formulary list, which means covered drugs, in an effort to reduce cost.

If this is the case you’d have to switch medications if you stay on the existing plan, or shop different Medicare Advantage plans or Part D plans which list the prescription on their formulary list.

THINK YOU BOUGHT THE BEST PLAN?

Often times we go on paying our monthly premiums year after year without a thought or care because checking the health insurance plan market is confusing and too overwhelming.

Some people do a ton of plan analysis when they initially enroll in Medicare at age 65, but never review their options again. This would be a mistake.

It’s a mistake not to check the options to check if there is a better plan waiting for you. The only constant in this world is change, particularly with health insurance. For example, certain states have massively different percentages in eligible individuals enrolled in Medicare Advantage plans vs. those enrolled in Original Medicare + Supplements.

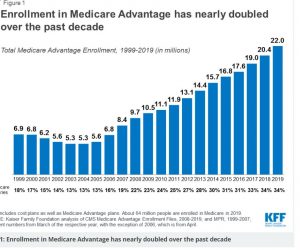

As you can imagine, some of these folks are not enrolled in the most appropriate plan for their situation. There are market conditions which are different in each state. The states with largely rural populations have very little Medicare Advantage enrollment due to lack of availability. Way below the national average of 30% population Medicare Advantage enrollment. Kaser Foundation Map below reflects recent Medicare Advantage enrollment growth by state and percentage.

Why? The Medicare Advantage plans require larger populations and medical professionals to support the financial model. Some regions have hospitals which maintain near monopolies in select areas. These can be more expensive for treatement and insurance contracting.

The only real constant is change. There are new plans always coming on the market. Insurance carriers expand coverage areas for plans. Drug lists change or get replaced.

You may love your plan, but if you can get the exact same benefits from a different insurance carrier and save a few hundred dollars per year wouldn’t it be worth it? Don’t presume your health will always be the same. It’s funny, some years back there was a study completed where most people when asked about the current state of health insurance market the replies were very negative. The market is terrible, the plans are too expensive, on and on.

But, when asked about their own health plan, people often surprisingly respond….”But my health plan is fine. What I have is good.” It’s easy to talk yourself into thinking your health will never get worse. But, the reality is, health situations change.

Just add up the number of medications getting prescribed!

80 percent of seniors ages 65+ take 2 prescriptions and 50 percent take four or even more.

Most of your major health insurance bills will typically happen in this phase of life. Make sure you have coverage which suits you now but also helps just in case something large and unanticipated strikes!

NEED HELP?!

There are a lot of resources out there to get help. You are not alone!

Don’t sit there and pound your head against the wall.

For starters, give us a call or email and we will answer your questions. 1-866-486-6551 or help@plansforhealth.com

To run an instant quote anytime click here:

Make sure you run through a checklist of items before choosing the plan.

Medicare Checklist

- Verify your doctors and hospitals are in network

2. Check your prescription drugs with the plan drug formulary list on either

a) Part D RX prescription plan if choosing Original Medicare + Supplement

b) Medicare Advantage bundled Part D prescription plan

3. Run quotes for all the available plans and insurance carriers in your area

4. Talk to us, an experienced agency, to make sure you understand your options and your plan choice

Check with Medicare.gov to make sure you’ve elected Medicare Part B. You can register your account on their website or just call them at 1-800-MEDICARE (1-800-633-4227).

There are other special enrollment period event where you can disenroll, enroll, or make changes to your coverage. We cover them in great detail here. But here’s a few of the more common ones:

Move out of the Coverage Area

Medicare Advantage plans have coverage areas or zones tied to medical groups and hospitals so if you move out of the coverage area it creates a qualifying event to enroll in a new Medicare Advantage plan or switch to Original Medicare.

Loss of Coverage

If you’ve recently lost an alternative health plan for example Employer sponsored coverage at your job, or become ineligible for a government program like Medi-Caid you earn a qualifying event to enroll in Medicare Advantage or Original Medicare.

Medicare Chronic Special Needs Plan

If you have a severely disabling condition which qualifies for SNP(special needs plan), and there is a Chronic Care Special Needs plan available in your area you may join it.

Once you use this Special Enrollment Period and join a plan, your chance to change plans again ends. It’s a one time only SEP.