OUR ASSISTANCE IS 100% FREE TO YOU!

CALL TO ENROLL BY THE PHONE IN

1/2 THE TIME

Sacramento Health Insurance Comparison And Reviews

Sacramento’s booming.

Blame it on the steady flow of people who don’t want to pay Bay Area expenses. Or maybe it’s that little thing called State capitol of a State the size of a large country.

Either way, Sacramento is definitely on the rise.

Lots of individuals and companies moving here or moving up in Sacramento. Eventually, the question of health insurance comes up.

Where to start on that question?

Right here.

It’s your total guide to comparing Sacramento health insurance carriers, plans, and rates.

Over 15 years experience as licensed

Sacramento health insurance brokers, we're here to help.

There’s no cost for our assistance Covered Ca is in the individual/family segment. Now you can jump to the right area.

If you want to jump right a specific topic, feel free here by market segment:

- Individual and Family coverage reviews in Sacramento

- Individual – Family Health carrier reviews and comparison

- Individual – Family Health Plan reviews and comparison

- Insurance rate comparison

- Small and large business health benefit reviews in Sacramento

- Sacramento Health carrier reviews and comparison for Small Business

- Health Plan reviews and comparison for business plans

- Insurance rate review for Small Business Group plans in Sacramento

- Medicare eligible health insurance reviews in Sacramento

- Health carrier reviews and comparison for Sacramento seniors

- Medicare Health Plan reviews and comparisons in Sacramento

- Sacramento Medicare Supplement Insurance rate reviews

The market segment piece is really important. Make sure you pick the right one! Each has its own rules, rates, and options in Sacramento.

Let’s get started. We’ll start with Individual and Family health reviews in Sacramento

Individual And Family Coverage Reviews In Sacramento

The Sacramento area market for individuals and family without Medicare is dominated by Covered California.

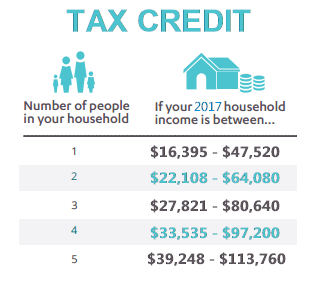

This is because of the tax credit!

We can help you figure out that piece based on:

- Household size – everyone that files taxes together

- Household income estimate – this year’s income (line 37 next April)

We’re happy to help with this calculation – our assistance as Certified Covered California Sacramento agents is free to you!

You can run your Sacramento Covered Ca quote here:

Let’s get on to the comparison and review. We’ll break down each section based on our interaction with the Sacramento carriers and plans. Let’s start with carriers in the county.

Sacramento Individual And Family - Health Carrier Reviews And Comparison

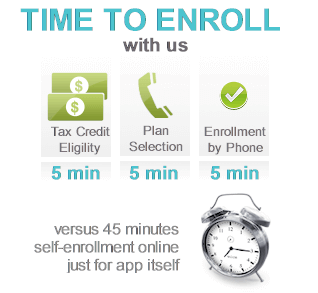

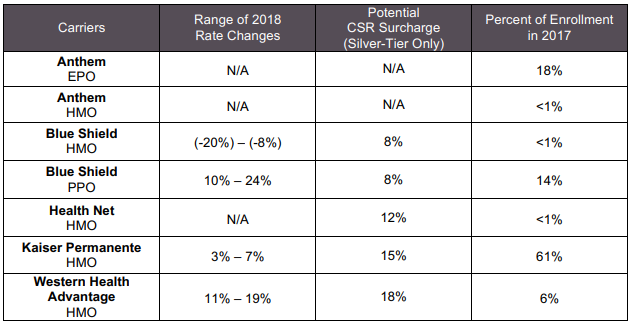

Kaiser has a huge footprint on the individual family market in Sacramento.

Take a look at Covered Ca’s 2017 enrollment breakdown:

61% is Kaiser in the greater county area.

Anthem pulled out of the area and Blue Shield ate up a great deal of their marketshare in 2018. Western Health Advantage was hit hard by their lost of UC Davis and Health Net hasn’t made much ground in 2018.

So really, it’s a question of Kaiser versus everyone else.

That’s always been the case but has accelerated over the past 1-2 years.

Since the plans are standardized, it really comes down to whether you want to be Kaiser’s network our use private doctors/hospitals like Sutter.

In Sacramento county, it’s driven by networks:

- Kaiser

- Sutter

- UC Davis

- Dignity Health

Those are the dominant health care providers (not insurers) so most individual families will pick their insurance plan to match their provider of choice.

Kaiser is an HMO so you must stay within their network of hospitals and doctors.

Of course the rates change as well.

You can quickly quote the major Sacramento carriers here:

Tax credits may be available through the “on-exchange” quote tab. Let’s look at the individual/family plans in Sacramento.

Sacramento Individual And Family - Health Plan Reviews And Comparison

What about the plans available? Great question.

First some key notes for individuals and family plans in Sacramento:

- The plans are standardized – same benefits at each given level

- Preventative is covered at 100% in-network

- Benefits have to be the same on or off exchange

- Rates and network are the same as well (although Silver might be different)

There are 4 basic levels:

- Bronze

- Silver

- Gold

- Platinum

If you’re income falls in the right range, there may be richer versions of the Silver plan on-exchange:

- Silver 70

- Silver 73

- Silver 87

- Silver 94

The rates are the same for the silver plans…just the benefits change for people in Sacramento.

In Sacramento, a large percentage of the population qualifies for tax credits.

Similarly, a large percentage qualify for the Enhanced Silver plans mentioned above:

If you qualify for the Silver 87 or 94, that’s really hard to beat.

You’re getting benefits similar to the Platinum plan for the same price of the Silver.

And a big tax credit!

The second most popular plan is the Bronze plan. The bronze is generally the lowest price option that allows more catastrophic coverage.

Gold and Platinum make up a very small percentage of the market due to their high costs in Sacramento.

Also, the richer Silver plans negate needing to go richer in benefits if you qualify.

You can quickly see if you qualify for these here:

Make sure to enter your household size and income estimate for this year.

Call us at 866-486-6551 or by email with any questions.

There’s no cost for assistance comparing the different health plans available in greater Sacramento.

Sacramento Individual And Family - Insurance Rate Comparison

How do the rates compare for these plans?

First, 91% of individuals in Sacramento who enrolled through Covered Ca qualified for tax credits.

That’s huge!!

This is why Covered Ca dominates the area for individual family.

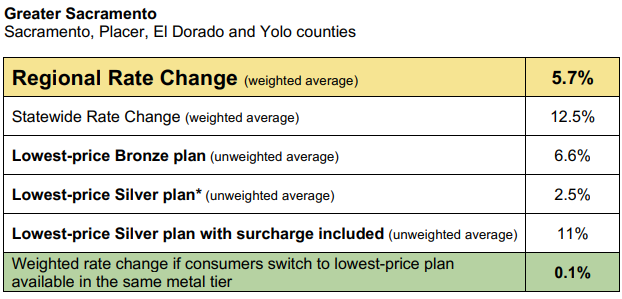

Here is the tally for recent rate increases:

There are two ways to compare and review health plan rates:

- By carrier

- By plan type

Let’s look at the carrier first.

Generally speaking, the rates at a given plan level (Silver for example) from lowest to highest:

- Kaiser

- Western Health Advantage

- Health Net

- Blue Shield HMO

- Blue Shield PPO

There are quotes for individuals that differ from this.

It’s important to run your Sacramento individual health quote here:

What about plan type?

Of course, the rates generally follow the benefit levels lowest to highest:

- Bronze

- Silver

- Gold

- Platinum

There can be situations where the Silver is actually higher than the Gold due to a quirk in the rating resulting from changes in Washington.

We really to run the quote since carrier differences can offset benefit level differences.

Meaning…a silver with Kaiser might be priced similarly than a Bronze from Blue Shield PPO.

You have to then weight the carrier trade-off versus very different benefit differences.

It can get tricky but we’re happy to help with any questions at 866-486-6551 or by email. Our assistance is 100% free to you.

Check your Sacramento family health rates here.

Small And Large Business Health Benefit Reviews In Sacramento

The Sacramento area has a robust and competitive group health market for employers.

All major carriers are present and they’re all dealing with a market dominated by Kaiser.

We’ll discuss the carrier situation below. This market is where we really shine as Sacramento health brokers.

We know all the players and options available. We can quickly size up your situation and find the best rates available.

It’s what we do daily…for the last 15 years+!

The Employer market is governed by the ACA health care law (Obamacare).

This has many different effects:

- Metallic level plans (bronze, silver, gold, and platinum)

- Small group is 1-100 employees

- Preventative is covered at 100% on all plans

- Mental health is covered as if medical for certain diagnosis

- Larger companies must offer group health or pay a fine

- Plans must cover 10 essential health benefits

Those are some of the big changes.

The standardized plan benefits really changed the market in Sacramento quite a bit.

There are also some general rules we have in California that affect group health:

- At least 75% of eligible employees must go with plan

- Employer must pay at least 50% of the lowest priced plan

- Majority of employees must reside in California

There are special offers from carriers all the time to relax these requirements.

There’s also a special enrollment window at the end of year where Sacramento companies can avoid many of these requirements.

We’re happy to help you navigate the qualification for group health benefits.

There’s no cost for assistance (ZERO) as licensed Sacramento group health brokers.

You can request your group health quote here:

Let’s get right into what drives the rates and options in the greater Sacramento area:

Group health carriers!

Sacramento Small Business Health Carrier Reviews And Comparison

In Sacramento, we have the full range of group health carriers to choose from.

Here’s the list of major carriers:

- Kaiser

- Cal Choice

- United Health

- Blue Shield of California

- Anthem Blue Cross

- Western Health Advantage

- Health net

- Aetna

- Sutter Health

These carriers make up the vast majority of the market for employer benefits.

Kaiser alone makes up more than half of the group health market!

They are the dominant force in the area.

But what about employees that want to continue with their doctors and hospitals outside of Kaiser?

Not a problem! We can just create a Kaiser wrap. In fact, we do this all the time in the area.

Basically, we can wrap Kaiser coverage around another health carrier in Sacramento.

You can even stipulate that the company contribution is based on one of Kaiser’s plans. For example, you can state you will pay 50% towards the employee cost for the Kaiser silver plan. The employees can then pick from any of the Kaiser plans or the alternate carrier (for example, United).

This way, the employer can determine their monthly budget and the carrier can choose according to their healthcare needs.

It’s by far the most popular way to offer employee health benefits!

How do we pick the other carriers alongside Kaiser?

That’s where we come in.

We run a quote at a popular plan level (Silver unless company wants other level) across all the carriers!

We then find the best priced for the largest network .

The plans are standardized in Sacramento so a Silver plan has to walk and talk like another SIlver plan by +/- 2%.

This makes it really easy!

If United is much cheaper. Great.

Blue Shield? Fine.

Cal-Choice. No problem.

We can then create worksheets for your Sacramento company to show Kaiser plans next to the alternative carrier by employee.

It will show their rate based on plan choice (after company contribution).

It’s the best approach and keeps Kaiser and non-Kaiser employees happy.

Of course, we’re happy to walk through the details on setting this up and how to compare the different plan levels.

The goal is to find the best benefits available to your employees for the lowest cost.

Point! We are licensed Sacramento group health brokers with all major carriers.

We have no preference other than to find you the best value.

Run your quote and let us get started:

If you want to investigate the Kaiser wrap, let us know.

One note on providers.

The group health market still have the robust PPO and HMO networks from before the ACA law.

We can get access to many of the strong medical networks (Sutter, UC Davis, Dignity, etc) with most of the major carriers.

If you have a preference there, please let us know when we run the quote.

Sacramento Group Health Plan Reviews And Comparison

Let’s look at the actual plans.

A few important notes for employers.

The plan benefits are standardized as we mentioned above.

Any given Silver plan will be pretty comparable to another Silver plan.

Even with another carriers!

If the copays are better, the deductible will be worse. It’s a series of trade offs.

Some general benchmarks for the different benefit levels:

- Bronze – high deductible, few copays if any, high max out of pocket

- Silver – Mid-level deductible, copays for office and rx, high max out of pocket

- Gold – low to no deductible, richer copays for office and rx, mid to high max out of pocket

- Platinum – no deductible, richest copays for office and rx, low to mid max out of pocket

Some key points for Sacramento companies:

- The most popular plan tends to be the Silver

- Bronze is generally second due to cost

- HSA plans may be a available at the Bronze and Silver level usually

- There can be HMO and PPO options available at each level

- Preventative is covered at 100% on all plans

- You can offer a range of plans and cap company contribution

There’s a lot to digest for most companies.

In 5 minutes, we can quickly size up a good offering based on:

- Company budget

- Type of industry

- Size of company

- Kaiser preference by employees

- The type of industry is really important.

- Group health benefits are really important to keep and retain great employees in Sacramento.

- The industry type will drive what’s expected.

We’re here to help

There’s no cost for our assistance as licensed Sacramento group health brokers.

Run your employer health quote or email us with questions.

Sacramento Employer Health Insurance Rate Reviews

What about rates in the Sacramento area for employer based health plans?

Here’s a general guide to price competitiveness from best priced down:

- Kaiser

- Cal-Choice

- Western Health Advantage

- United Health

- Blue Shield of California

- Anthem Blue Cross

- Health Net

- Aetna

Keep in mind that this can differ depending on age and family makeup for your employees.

It’s best to have us run a quote a given plan level (Silver for example) across all carriers.

We can also investigate whether we might get tax credits for Covered California.

The two main requirements for group health tax credits are:

- 25 or fewer employees

- Less than $50 average salary (not including owners and officers)

If you might meet those criteria, let us know and we’ll quote Covered California employer health options as well.

Run your Sacramento business health quote here:

Feel free to call us at 866-486-6551 or email with any questions at all!

We have helped 1000’s of Sacramento companies find affordable group health benefits.

Medicare Eligible Health Insurance Reviews In Sacramento

Sacramento has many different options to individuals with Medicare.

The Advantage plan market has exploded in this area due to the affordable monthly cost.

Medicare options are generally for:

- People age 65 and older

- People with permanently disabled status

If you have Medicare part A and B, we can generally enroll in a supplement or Advantage plan.

Medicare supplements are also very prevalent for people who want more of a PPO type option.

The carriers are very aggressive on both fronts.

It’s important to first understand the differences between Advantage plans and Medicare Supplements.

We’re happy to walk through how they work.

You can quote both in the Sacramento area here:

To some extent, this question is addressed for most people based on the carrier of choice.

Let’s touch base on that first.

Sacramento Medicare Health Carrier Reviews And Comparison

Many seniors in the greater Sacramento area are members with Kaiser.

If you want to stay with Kaiser via Medicare, we’re looking at an Advantage plan.

If you want to keep seeing doctors and hospitals outside of Kaiser, we would investigate supplements and advantage plans from other carriers.

Supplements are pretty easy in that you can see any doctor that accepts Medicare.

Advantage plans are HMO’s and therefore have a network of Sacramento doctors and hospitals that you must use to get benefits.

When you run your quote below, you can bring up the provider network for any given Advantage plan.Again, you won’t need to do this for supplements.

Just make your doctor or hospital takes Medicare.

Sacramento Medicare Health Plan Reviews And Comparisons

The Supplement plans are standardized which means that an F plan has to have the same benefits as another F plan with a different carrier.

This makes it easier to compare.

So which plan is popular with supplements for Sacramento seniors?

- The F plan has always been the most popular, but is now phased out for turning age 65 new eligibility Medicare folks in 2020

- The G plan has replaced the F plan as the Medicare Supplement of choice since the F is phased out .

- Otherwise, many people also look at the high deductible G plan for more catastrophic coverage with the benefit of lower premiums.

Sacramento Medicare Supplements - Insurance Rate Reviews

As we mentioned above, the F plan has been very popular.

Anthem Blue Cross introduced a Innovative F plan which is generally priced the best and has add-on benefits such as hearing aid and vision coverage.

It’s hard to beat in the Sacramento area for Medicare supplements.

Otherwise, the rates really depend on age and carrier.

Advantage plan pricing is all over the place.

For those plans, it’s best to run the instant quote and compare!

Use our agent experience with over 15 years exclusively in the Sacramento health insurance market.

There’s ZERO cost for our assistance.

Feel free to run any questions by us at 866-486-6551 or by email.

How can we help?