OUR ASSISTANCE IS 100% FREE TO YOU!

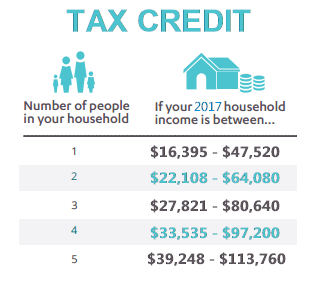

CALL TO ENROLL BY THE PHONE IN

1/2 THE TIME

How To Find Best Small Business Health Insurance In Sacramento

Need to purchase Small Group health insurance for your small business size 1-100 employees in the Sacramento area?

Where should you start? So much information to process! Let’s face it, you need some help and fast.

Don’t know where to begin?

Luckily we work with small businesses every day on health plans. Here’s where to start:

How do you choose the right plan for your employees?

Choices, choices, choices!

There’s just so many choices! When looking around at health insurance quote you will instantly become overwhelmed with high prices and thousands of plan choices. After managing company benefits for many years, believe us, we hear you.

Without studying the industry for hours and hours, how do you know what's best?

Unless you have some insurance industry experience, it is impossible to figure out what all the terms, plans, and rules mean without some market knowledge and help from someone you can trust.

We know it’s hard. With so many choices then, how do you choose the perfect plan for both your employees and for your owners & executives? Surprisingly, the answer is you don’t.

It’s our job to make this simple.

The best way to choose a health plan for your employees is not to choose just one! Different people have vastly different medical and financial needs.

Here’s the plan:

- come up with a dollar amount you can afford to pay for each employee, then…

- offer high/med/low health plan options so employees can choose their own plan.

This way, your young, entry level employees in their 20’s who never go to the doctor, and make less money, can choose a low cost health plan.

But, an executive at the company who wants a richer plan and has the higher salary to pay for it can enroll in the strongest plan.

Everyone is happy!

Best of all, you don’t have to listen to any complaints about the health plan.. Because your employees chose their own.

Here’s an example of a simple benefit table reflecting a plan benefits of a company offering 3 high/medium/low cost plan options at Anthem Blue Cross of CA:

How do you make sure the health coverage is strong enough for your valuable employees without going broke?

Consider enrolling in a local HMO Carrier plan. HMO plans can be both good and bad.

There are lower cost premium health plans available, but the flexibility of a PPO plan to see more specialists or treatment options outside the geographic area is more difficult.

Local HMO health carriers offer managed care access to locally contracted medical groups and hospitals.

We cover this more in great detail here. In our local area, with Sacramento HMO carriers such as Western Health Advantage, SutterHealthPlus HMO, & Kaiser Permanente we have lots to choose from. But, these 3 offer some of the best rates and coverage available.

Upside?

- HMO plans can reduce premiums and limit out of pocket costs on medical expenses.

- one stop shopping’ at a single primary care doctor and medical group managing your treatment.

Check to see if your doctors accept an HMO plan through the quote today.

Here's some quick highlights on each local Sacramento HMO insurance companies:

Western Health Advantage

Western Health Advantage is a great local Sacramento HMO plan which is one of those companies providing great customer service every time you contact them.

- Doctors trust working with Western Health Advantage – you trust your doctor.

- Access to leading medical providers in the area: UC Davis Medical Group & Center, Dignity Health/Mercy Medical Groups, and Hill Physicians.

- Great customer service: 92% of Western Health Advantage providers surveyed would recommend Western Health Advantage to other Physician medical group practices

- Mature, established technology, including billing and customer service systems

SutterHealthPlus

- A premier medical care provider a quality care for Northern California

- Simplified access: Sutter Medical Group, Sutter Independent Physicians, and Sutter Hospitals all within the same company and now the insurance plan too.

- Reached 50,000 member milestone last year after launching insurance plan in 2014

If your primary care doctors, specialists, and hospitals are all typically at Sutter Health, this could be a great option for you.

Historically Sutter is purely a medical provider and not an insurance company: big difference. Their new option of providing the insurance too compares to the Kaiser HMO, but they don’t have the infrastructure yet of course.

This might lead to some growing pains like:

-their computer systems integration links are immature between insurance plan and doctors, hospitals, lab, pharmacy

-the billing system is new and not “real time” vs. live member enrollment system

Kaiser Permanente

Kaiser has made great strides in the industry as the only technically pure HMO by definition: owning the medical care “end to end” including facilities, treatment programs, insurance, doctors, nurses, providers etc…everything.

- In Sacramento, they cover about 50% of the insured population

- Kaiser is the largest health insurance carrier in California This gives them financial leverage and negotiating power when purchasing supplies, equipment, medications, etc.

- Kaiser has been around for decades and has some of the best website membership systems on the market.

They’ve invested greatly in technology management systems as a way to improve service.

Your patient records are held in one system so any Kaiser doctor, lab, hospital, or pharmacy can see your single patient medical history.

“One- stop shopping” is a huge convenience and reason people buy Kaiser.

Online Access

At www.kp.org through your member account you can email your doctor, schedule appointments, fill prescriptions, view lab results, and view claims.

The member website is amongst the most robust and feature rich in the industry.

Accessing health care with Kaiser:

What are the downsides to these HMO’s?

Can you see outside specialists?

With Kaiser there is no access to care outside Kaiser services without express permission. Kaiser typically attempts to treat conditions “in-house” obviously to control costs.

Remember, this is a healthcare model where a large component is based on managing cost. When you are the company paying for the medical treatment, cost matters.

What is managed care?

One of the downsides is with the HMO, or Health Maintenance Organization, is that when you enroll you accept the “managed care” model, which means your medical conditions will be managed according to an insurance plan “schedule of benefits.” The insurance carrier and doctor will follow a specific, pre-determined course of treatment for each medical condition type. This amounts to giving up some control over your medical care as you and your doctor must follow the procedures.

What about second opinions if you’re not happy with a diagnosis or treatment? When seeking specialists the HMO primary care doctor will send you to the specialist available within the same medical group. If you are happy with that doctor, great.. Then there’s no problem. If you want another specialist’s opinion or different specialist the HMO can tell you “No”. The only way the HMO refers a member outside the HMO medical group is if they do not have the expertise in house to diagnose and treat the condition.

Getting Access to your Doctors

Which insurance carriers & plans will give you access to your doctors & hospitals?

If your health plan doesn’t give you access to your doctors and hospitals, then what good is it? How would you receive medical care without the doctors you trust?

Do it the easy way! Email us a quick list of your doctors, medical groups, and hospitals and we will send you a list of health insurance plans and carriers who accept the coverage.

Prefer doing it yourself? Here’s links to the health insurance carrier doctor and hospital search tools so you can find them easily.

Small Business Plan Doctor Search

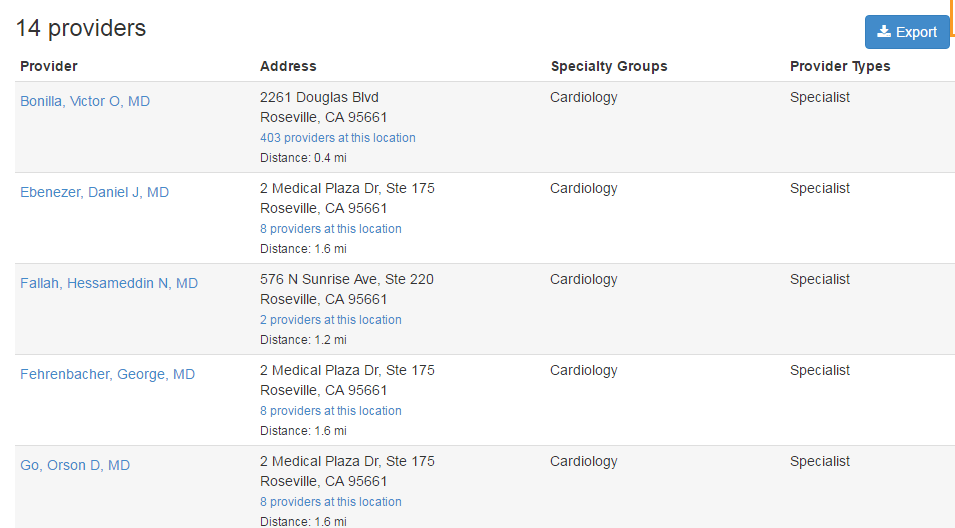

Here’s a sample table report of the data we can provide. It’s easy! Simply:

a) Type in your zip code or city

b) Type in the doctor specialty

c) Type in the name of the insurance carrier and PPO or HMO plan

In our example we searched for cardiologists within 5 miles of a specific zip code for Blue Shield. Here’s what came up:

Pretty nice right?

You can then click through and get details on the doctor, other plans accepted, contracted medical groups, and hospitals.

We offer you this great tool for free which lets you look up just about every plan on the market and check your doctors for status, or find new ones who take the plan. That way, you know the plan you’re buying gets you the treatment you need.

How Much Should You Contribute Or Pay Toward Your Employee Premiums?

There’s really two methodologies we suggest depending on your priorities.

Flat Dollar Amount

If you prefer limited exposure for company cost then you can establish a set dollar amount to pay towards each employee. This gives you the advantages of a fixed and predictable budget.

You could also decide to offer one or many plans to your employees. Either way your cost is fixed but your staff will appreciate different plan options.

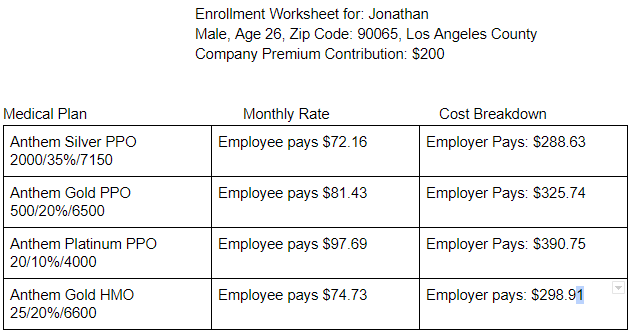

Here’s a great example of a flat dollar amount premium contribution but multiple health plans offered to an employee:

Different strokes for different folks

Since you might have certain employees who might be young in their 20’s, and never using their health plan, they might be looking for the cheapest option. Or, you might have an older employee in their early 60’s who uses the plan frequently, takes several medications, and has an occasional medical procedure. This staff member will clearly take a richer health plan.

Percentage Contribution

Here’s an example of the costs an employee and employer would face if the employer paid, for example, 75% of the employee side only premiums.

Notice the difference?

Employer pays more of total premium the with lowest cost Silver plan. Then, the employee out of pocket increases more gradually towards stronger options. This method works better when you’re interested in protecting the employee more, and less concerned with just the company bottom line.

Base Plan

You could base the percentage contribution towards all plans offered or it’s very popular to pay a percentage of a “base plan” only, and allow employees to “buy up” and pay the difference in cost above your “base plan.”

Use A Broker

What do you need a broker for? Can’t you just pick a plan and get it over with?

You could, but it might be the biggest mistake you can make. It’s free to you, and a good insurance broker can be an invaluable resource in benefits management, and again they’re free.

It’s not fair to you.

-as the employer to be burdened with constantly changing rules and regulations, the Affordable Care Act, give or take ten major California insurance carriers (depending on the year), and the many other hats a small business HR manager must wear. A broker who does their job properly at the highest level provides you with:

-excellent customer service for your questions and transactions (employee additions/terminations)

-helps to craft a benefit plan design with you for the long term, meeting specific needs your company might have. For example, you may need one plan for factory workers within a union, and another type of plan suitable for your travelling salespeople.

-assistance with HR operations model: builds benefit documents and helps with employee communications

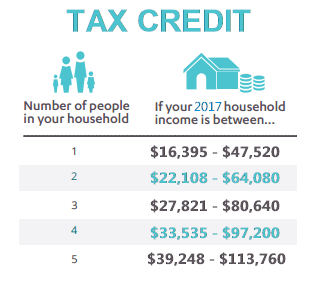

Tax Benefits

One of the great benefits purchasing Small Business employer health insurance are the tax benefits the IRS allows to encourage businesses to offer health plans to their employees.

Employer Deductions

Health insurance premiums are generally speaking tax deductible to the employer for the part they contribute to an employee’s premium as a business expense. Without this tax deduction, many employers nationwide would not offer employee benefits.

Employee Perks

Through a portion of the IRS code called Section 125 P.O.P., employees are allowed to pay their portion of the premiums which is deducted through their payroll with “pre-tax” payroll dollars. Many states allow the deduction to be “pre-tax” as well. This give the employee a discount on the cost of their premiums.

The section 125 POP implementation also reduces the Employer FICA tax amounts and the workers compensation costs.