BEST MEDICARE SUPPLEMENT PLANS IN CALIFORNIA

Turned 64 lately and seen your mailbox get stuffed with junk mail?

We know.

If you've decided you want to go the Original Medicare + Supplement (PPO Style) plan path to get:

- access to the Original Medicare FFS network (PPO Style) with the largest provider network in the nation

- ability to travel anywhere in the nation to seek Original Medicare providers for medical treatment

- minimal out of pocket expense when combined with a Medicare Supplement to fill the gaps

What then, are the BEST MEDICARE SUPPLEMENTS in CALIFORNIA?

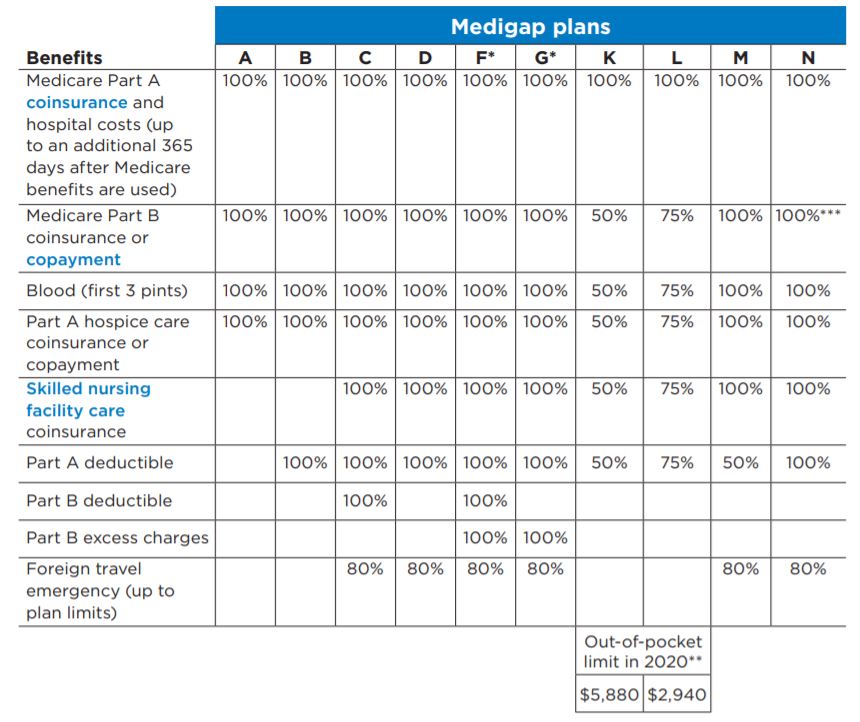

First, here's a chart of all your current California Medicare Supplement choices

![]()

As you can see, for new enrollees first eligible in 2020 the G Medicare Supplement plan covers the most gaps in Original Medicare A&B versus the other Medicare Supplement plans.

If you are newly eligible for Medicare in 2020 it's tough to beat the G Plan Supplement really at any California health insurance carrier.

For example, with Original Medicare Part A&B enrollees the G plan supplement covers the whole Hospital deductible, currently running at $1452, up from last year's $1364. This gives you the first 60 days of Hospitalization.

What about Part B outpatient & physicians services? Medicare Supplement plans are no longer allowed to cover the Part B

deductible of $198 on your behalf.

So, NONE of the Medicare Supplements will cover the Part B deductible for you anymore but the G plan covers the most.

Each year you have to pay the Part B deductible for things like doctors office visits, lab work, x-rays etc..

But, of the remaining medical expenses the G plan does the best job at filling in the gaps in Medicare.

The main question now is cost. How can you find the cheapest one?

Contact Us to find the best G Medicare Supplement plans rates in your area, or run an instant quote here:

![]()

If you turned 65 prior to 2020 but did not elect Medicare Part B or Part D RX because you chose to stay on your or your

spouse's Employer sponsored plan you have another option which is one step stronger than the G Plan Supplement.

If you worked past age 65 and delayed your Medicare enrollment until now, but were originally eligible for Medicare in 2019 then we suggest the Medicare Supplement F plan.

This is because the F plan and the G Plan are the same, except the F plan covers the deductible for Medicare Part B Outpatient and Physician's services, currently sitting at $198.

![]()

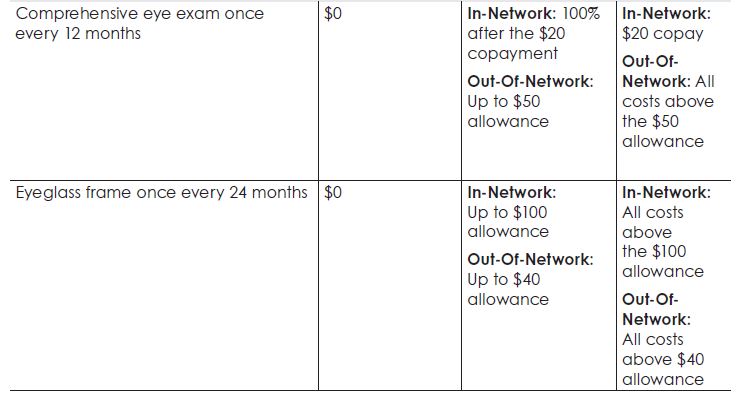

Getting older sometimes isn't all that fun. Do you need eyeglasses or contacts, or have issues hearing from time to time?

Next in line we suggest considering is the Blue Shield G Extras Medicare Supplement.

It's one of the best Medicare Supplement values on on the California market. Why? What do you get?

G Extras supplement adds additional benefits to Original Medicare.

G Extras adds vision coverage from VSP!

VSP, or Vision Service Plan, is award winning and the biggest name in vision care insurance in the nation.

G Extras members can take advantage of the largest provider network in the U.S. for eyecare services of independent Physicians, Opticians, and Opthamologists.

VSP members receive a lower rate for vision expenses when visiting a contracted 'in-network' provider.

You can still use the VSP plan visiting a doctor 'out-of-network' but you will pay more for your services and will not receive negoitated rates.

Select eyeglass lenses also available every 12 months for $0 after $25 office visit co-pay limited selection.

To find a VSP provider who is contracted visit blueshieldca.com and click on Find a Doctor.

Blue Shield G Extra also adds to Medicare coverage additional hearing benefits.

What does this mean? Do you get coverage for Hearing Aids?

Yes!

Blue Shield has partnered with EPIC Hearing Healthcare to give G Extras members access to EPIC Hearing providers.

Blue Shield G Extra Supplement gives you coverage for both hearing exams and allowances toward EPIC provider hearing aids which Medicare does not cover.

|

MEDICAL EXPENSE |

YOU PAY |

|

Hearing Aid Exam |

$0 |

|

Basic Hearing Aid Level |

$449 |

|

Reserve Hearing Aid Level |

$699 |

Basic Hearing Aid Level Includes

- 1 'behind the ear' hearing aid delivered to your home

- follow up visits free for phone or video, or optional in person at $50 co-pay

Reserve Level Hearing Aid

- 1 hearing aid delivered to your home

- Up to 3 follow up visits including hearing check, adjustment,

- ear impression & molds

Health Net of CA comes on strong with their "Innovative G" Supplement Plan.

Health Net of CA Innovative G Supplement offers all the regular coverage the standard G Supplement gives you, plus additional benefits Medicare does not cover.

These benefits in addition to Medicare include:

|

Medical Expense |

Health Net Innovative G Pays |

You Pay |

|

Routine Eye Exam every 12 months |

100% after co-pay contracted providers |

$45 Co-Pay |

|

Frame and Lenses every 24 months |

$250 Allowance |

80% remaining balance |

|

Contact Lenses every; 24 months |

$250 Allowance |

85% or 100% of balance |

*coverage is only a high level description. Actual payment subject to contract terms, contracted provider status etc..

Yes, Chiropractic and Acupuncture is finally in a Medicare Supplement plan. Seriously.

Health Net Innovative G Supplement offers limited routine Chiropractic and Acupuncture coverage in addition to Medicare.

What do you get?

20 total combined routine Chiropractic or Acupuncture visits per year at $0 co-pay!

Blue Shield could have sat back and simple offered the standard Medicare plans plus the G Innovative Supplement to add the hearing aid and vision coverage.

It is truly an innovation and stands tall amongst California Medicare Supplement offerings.

Are we inspired? YES!! Here's why.

Blue Shield G Plan Supplement gives you everything you get in the regular G Plan Supplement, as well as the Hearing Aid and VSP vision plan coverage but also adds AAA roadside service to the coverge.

Here's the Medicare G Inspire coverage details (AAA also availabe in select Medicare Advantage plans):

Classic AAA roadside service 24/7 for one year

AAA Roadwise Driver Online driving simulator to assist with training

Educational Driving Resources A website containing educational, instructional tools, and advice about driving and road safety.

RoadWise RX

http://www.roadwiserx.com/

AAA offers a medications lookup tool called Roadwise RX to help individuals determine whether they should be driving, or if their prescriptions may cause an impairment when mixed with other medications or over the counter impacts.

All Blue Shield Medicare Supplements include the Silver Sneakers participating basic gym access at $0 charge.

These are all fabulous additions to Original Medicare coverage at a price lower than most standard G Supplement plans provide.

The F Plan Supplement and High Deductible F plan supplement were removed from the market to new eligible Medicare individuals turning 65 starting in 2020.

WHAT!!! The F Supplement plan was the most popular plan on the market by a long shot.

If you were paying for your own individual plan when under the age of 65 you may have enrolled in a high deductible plan to reduce monthly premiums.

If you're lucky to be healthy and mostly visit your doctor for annual physicals, there's no need to give the insurance carrier your hard earned premium dollars up front.

Why isn't there something similar offered with Original Medicare plans?

Turns out there is!

Mutual of Omaha offer a high deductible G plan for about $47 per month in S. California.

This is a significant drop in premium cost monthly vs. the standard G Supplement plans which can range between $100-$250 range.

What's the difference in coverage?

High Deductible G plan includes a $2450 deductible which includes both Part A Hosptial & Part B Physicians & Outpatient Services.

This means you have to pay the first $2450 out of pocket for both Part A Hospitalization costs and Part B doctors office visits. Each type of medical expense will apply to the deductible.

Do you still have to pay for the $198 Part B deductible? Yes and No. It's included within the $2450, so you're paying for it but not in addition to your new $2450 deductible.

If you're paying about $35 for the high deductible G (albeit with $2450 in deductible risk), vs. $125 approximately for the standard G Supplement and you don't end up visiting the doctor for the year you've saved:

$35 monthly premium * 12 months= $420 annual cost if you have no medical claims

But does it include the vision, hearing, and gym membership benefits seen on some of the G plans with extra benefits?

Sorry, but I have bad news. No, it does not.

Who would buy this plan then?

Someone who fits the following description:

The person enrolling in this plan needs to be able to afford a single bill of $2450 in case of unexpected large medical expenses.

With any questions please feel free to contact us via email or call at 1-866-486-6551